The growth of E-commerce

The growth of E-commerce

Electronic business has now been on the scene for around three decades, and in that period it has changed the procedures of purchasing and offering merchandise. Its proceeded with increment is changing the nature, timing, and innovation of both business-to-business (B2B) and business-to-purchaser (B2C) trade, affecting evaluating, item accessibility, stock holding, transportation examples, and shopper conduct in created economies around the world.

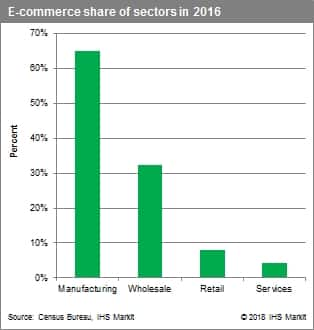

Business-to-business electronic trade represents by far most of E-commerce deals and assumes a main job in worldwide production network systems. Its ascent in the course of recent years has been quick. In 2003, around 21.0% of assembling deals and 14.6% of discount deals in the United States most by far of which comprise B2B exchange were led by means of web based business. By 2016, web based business had assumed control, making up 64.8% of assembling and 32.4% of discount deals. Albeit internet shopping gets the most prominent consideration, web based business retail deals are overshadowed by electronic deals in both the assembling and discount areas. Of the total of these three, producing web based business makes up 56% of internet business deals, discount makes up 38%, and retail deals represent a simple 6%

Although it started relatively behind, e-commerce retail sales is playing catch-up and its growth has outpaced that of the wholesale and manufacturing sectors for 12 of the 14 years leading up to 2016. Between 2003 and 2016, retail e-commerce has averaged 17.0% annual growth, compared with 7.3% and 12.2%, respectively, for wholesale and manufacturing. In the principal quarter of 2018, occasionally balanced online business retail deals grew multi year on year. The offer of retail deals led by online business in 2016 was just 14.5% notwithstanding while barring deals at auto and automobile parts merchants, service stations, sustenance and refreshment stores, eateries still a long ways from assembling 64.8% offer. Be that as it may, this offer is rising quickly; most as of late, in the primary quarter of 2018, it bounced to 17.1%. The retail internet business unrest is being helped by classifications of products that have customarily been deserted; the sustenance and drinks classification, specifically, is seeing its still-little online nearness grow rapidly, thanks to some degree to Amazon’s buy of Whole Foods.

As innovation, online business, and globalization turn out to be more interwoven, purchasers and venders are expanding their availability and the speed with which they lead deals exchanges. One outcome is that organizations could keep up littler inventories of merchandise close by, as electronic sourcing and deals create further markets and greater adaptability in adjusting to request conditions. Recorded stock to-deals proportions have been inclining significantly descending as far back as the mid 1990s for the two retailers and makers. Between the principal quarters of 1992 and 2018, the proportion of inventories to deals has diminished by 17% for makers and by almost 24% for retailers barring automobile merchants. By differentiation, this proportion for wholesalers-whose plan of action rotates more around the coordination’s of putting away merchandise has declined by unimportant 2%.

The growth of online business retail sales has also reduced clients’ search cost, placed downward pressure on many clients’ prices, and reduced price dispersion for many consumer goods. Consumers have benefited from sharply reduced goods prices; annual growth of the price index for US client’s commodities excluding food and energy was positive in only 2 of the 61 months since April 2013. E-commerce is clearly responsible for some of this downward pressure on inflation. It has additionally delivered moves in shopper shopping designs. Somewhere in the range of 2003 and 2017, the normal measure of time Americans spent shopping on ends of the week and occasions tumbled from 0.56 of a hour to 0.46-a 18% decrease.

The move to E-commerce is likewise unmistakable in labor markets. Starting in 2010, non store retail work took off, ascending from a normal of 420,000 to 570,000 of every 2017 with its employments share ascending to 3.6%. In the course of the most recent two years, add up to retail work has generally slowed down, expanding by just 68,000 between April of 2016 and 2018, even as work at non store retailers achieved exceptional highs, expanding by 62,000 over a similar period-in this way making up 92% of the aggregate part’s business development. These generally couple of laborers, who can process a far higher volume of exchanges with the help of online requests and stockrooms, are tearing up the retail area’s occupations. Then again, the fast development of online business retail deals has given a noteworthy lift to private package conveyance administrations, which are expected to get the merchandise into customers’ hands. Somewhere in the range of 2012 and 2017, work of dispatches and delivery people soared from a normal of 535,000 to 685,000.

With web based business representing just 8.0% and 4.2% of retail deals and offers of administrations, separately, the B2C electronic transformation still has far to go. Not with standing, for the two segments, the wide state of the outcomes is clear: bring down costs for products; more profound, more proficient, and more aggressive markets; and disturbance for organizations that are abandoned.